Reserve Bank of India has banned financial transactions on Paytm Payment Bank. Millions of customers are affected. Whether transactions can be done in Paytm after February 29, what will happen to the money deposited in the Paytm wallet-thousands of such questions are running in the minds of Paytm users.

But the biggest question is, why has RBI banned the financial transactions of Paytm Payment Bank? What crime did this digital payment bank? According to sources, there has been widespread corruption in KYC information. Hundreds of accounts have no real identity. Customer name, information – all unknown. Crores of financial transactions have taken place from these accounts without KYC.

By infosecbulletin

/ Saturday , July 27 2024

Risk of cyber attack, the country's main stock market Dhaka Stock Exchange (DSE) and Chittagong stock exchange (CSE) website is...

Read More

By infosecbulletin

/ Saturday , July 27 2024

Google fixed a bug in Chrome's Password Manager that caused user credentials to vanish temporarily. A problem with Google Chrome's...

Read More

By infosecbulletin

/ Saturday , July 27 2024

India’s Communications Minister Chandra Sekhar Pemmasani confirmed a breach at the state-owned telecom operator BSNL on May 20 during a...

Read More

By infosecbulletin

/ Saturday , July 27 2024

Malware based threats increased by 30% in the first half of 2024 compared to the same period in 2023, according...

Read More

By infosecbulletin

/ Friday , July 26 2024

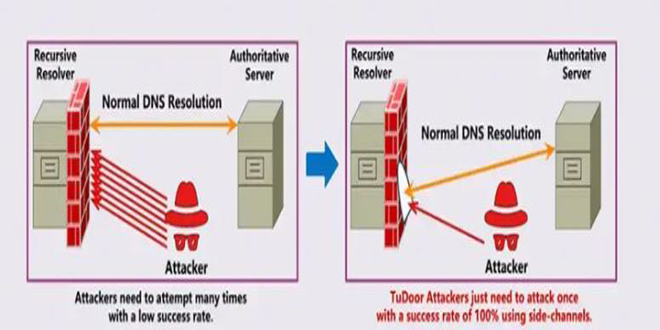

A new critical vulnerability in the Domain Name System (DNS) has been found. This vulnerability allows a specialized attack called...

Read More

By infosecbulletin

/ Friday , July 26 2024

A serious vulnerability, CVE-2023-45249 (CVSS 9.8), has been found in Acronis Cyber Infrastructure (ACI), a widely used software-defined infrastructure solution...

Read More

By infosecbulletin

/ Friday , July 26 2024

OpenAI is testing a new search engine "SearchGPT" using generative artificial intelligence to challenge Google's dominance in the online search...

Read More

By infosecbulletin

/ Thursday , July 25 2024

CISA released two advisories about security issues for Industrial Control Systems (ICS) on July 25, 2024. These advisories offer important...

Read More

By infosecbulletin

/ Thursday , July 25 2024

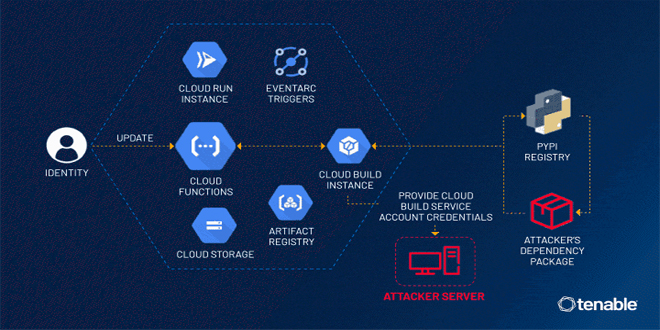

Tenable security researchers found a vulnerability in Google Cloud Platform's Cloud Functions service that could allow an attacker to access...

Read More

By infosecbulletin

/ Thursday , July 25 2024

BDG e-GOV CIRT's Cyber Threat Intelligence Unit has noticed a concerning increase in cyber-attacks against web applications and database servers...

Read More

It is known that KYC is mandatory for financial transactions. But Paytm Payment Bank did not follow that rule. Paytm has multiple accounts, which do not have KYC information. Crores of crores of rupees have been transacted from these nameless accounts. The Reserve Bank suspects that a huge amount of money has been laundered through Paytm Payments Bank. That is why RBI has banned the financial transactions of Paytm Payment Bank.

According to sources, more than 1,000 accounts were linked to a single Permanent Account Number or PAN. When the Reserve Bank of India and the auditors do the verification, they find massive irregularities. It was then that the Reserve Bank imposed financial sanctions on Paytm. The Enforcement Directorate has also been informed. It is learned that the Ministry of Finance and the Prime Minister’s Office have also been informed about this possible financial fraud.

Revenue Department Secretary Sanjay Malhotra said that the ED will look into whether financial corruption and illegal activities have taken place through Paytm Payment Bank.

Source: Times of India. Outlook India, TV9bangla

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind