Bangladesh, a nation known for its potential and resilience, has recently embarked on an exciting journey into the digital age with its Digital Bank initiative. By integrating modern technology into the financial sector, Bangladesh is committed to embracing innovative solutions that foster economic growth. This Digital Bank initiative is particularly noteworthy, as it seeks financial inclusion for its vast populace, including those in the most remote areas. This transformative move positions Bangladesh in sync with global advancements, indicating its ambition to play a crucial role in the digital financial world.

The Concept of a Digital Bank

A digital bank represents a new age of banking, operating primarily online without the reliance on traditional physical branches. It employs technology to offer various services, such as savings and current accounts, loans, and investment opportunities. The crux of its appeal lies in the 24/7 accessibility, enabling users to conduct banking operations anytime, anywhere, provided they have an internet connection. For a country like Bangladesh, this innovation promises a transformative shift in banking, especially for regions previously underrepresented in the traditional banking system.

Digital banks, or neobanks or challenger banks, have been designed to cater to various financial needs by offering innovative and technology-driven services. While the terminologies can sometimes overlap, there are some distinctions. Here are the primary types of digital banks:

Retail Digital Banks:

These cater to the everyday banking needs of individual consumers. They offer savings accounts, checking accounts, loans, and payment solutions. Customers can manage their finances, transfer money, and even make payments directly through apps or websites. Examples include Monzo, Starling, and N26.

Business Digital Banks:

These are designed for businesses, startups, and entrepreneurs. They provide services like business accounts, payment processing, and expense management and often integrate with accounting software. Examples are Tide, Qonto, and Mercury.

Investment Digital Banks:

These platforms are focused on investment services. They might offer robo-advisory services, stock trading, or other investment solutions. Betterment and Wealthfront are good examples.

Wholesale and Transaction Banks:

These digital platforms provide services to other banks or large financial institutions. They may facilitate large transactions, trading services, or other B2B financial processes.

Open Banking Platforms:

This is a newer concept wherein banks provide a set of APIs that third-party developers use to build applications and services. It allows consumers to share access to their financial data, enabling third-party companies to create new financial products around them.

Marketplace Banks or Banking-as-a-Service (BaaS):

These platforms allow third parties to offer financial products within a bank’s ecosystem. It’s like an app store but for banking products. The bank provides the infrastructure, while third parties provide specific services.

Neo-Banks:

While often used interchangeably with digital banks, neo-banks usually operate without traditional banking licenses. They frequently partner with conventional banks to offer services, focusing primarily on user experience and unique features.

Challenger Banks:

These banks challenge the dominance of traditional banks by offering a fully licensed service with a primarily digital model. They often combine features of retail and business banking.

As the banking industry evolves, these categories might see more subtypes emerge, driven by technological advancements and changing consumer needs. The distinction between each type might also blur as digital banks diversify their offerings to cater to a broader audience.

Cybersecurity Challenges in Digital Banks

With great innovation comes great responsibility. One of the primary concerns of digital banks is cybersecurity. Being wholly reliant on online operations makes them susceptible to diverse cyber threats like data breaches, phishing scams, and malware attacks. Furthermore, the limited internet penetration and digital literacy in parts of Bangladesh can exacerbate these risks, as uninformed users might be more prone to falling for cyberattacks.

Adopting digital banking in Bangladesh, especially given the mentioned challenges, amplifies the cybersecurity risks associated with digitising financial services. Here are some specific cybersecurity risks that Bangladesh may face:

Phishing Attacks:

Scammers may send emails or SMS messages mimicking genuine bank communications, aiming to trick users into providing sensitive information, such as passwords or account numbers.

Malware and Ransomware:

Given the relatively low levels of digital literacy, users may inadvertently download malicious software that can steal or encrypt data and demand ransom.

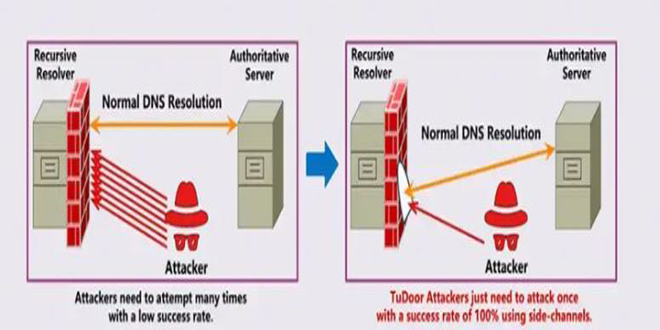

Man-in-the-Middle Attacks (MitM):

Attackers may intercept communication between the user and the bank, capturing sensitive data during the transaction process.

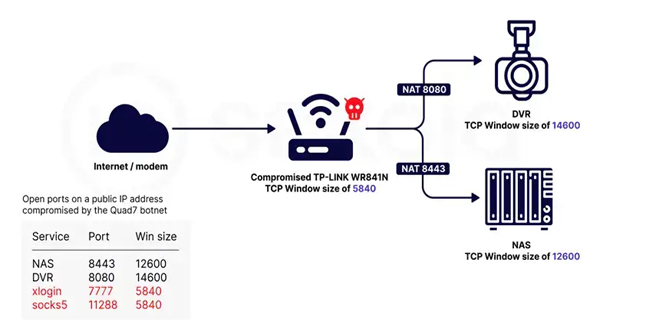

DDoS Attacks:

Digital banks may become targets for Distributed Denial of Service attacks, disrupting banking operations and eroding trust.

Unsecured Mobile Applications:

If the mobile apps of digital banks are not coded securely, they might be vulnerable to attacks, leading to data breaches.

Weak Authentication Protocols:

Without robust authentication mechanisms like two-factor authentication (2FA) or biometric verification, digital bank accounts may be easier to breach.

Insider Threats:

Employees or individuals accessing the digital bank’s infrastructure might exploit the system for malicious or personal gain.

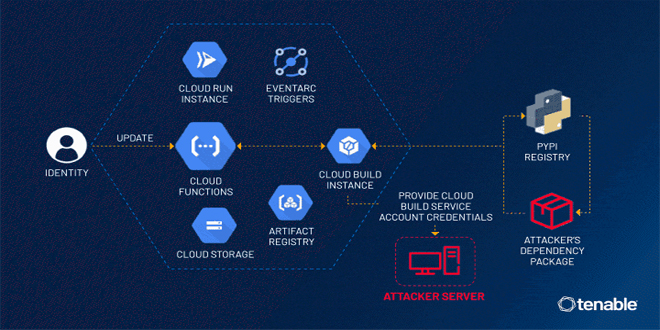

Unsecured APIs:

Many digital banks integrate third-party services using Application Programming Interfaces (APIs). If not secured properly, these can become entry points for attackers.

Data Breaches:

Given the large amount of personal and financial data stored, digital banks are lucrative targets for cybercriminals. Inadequate security measures can lead to significant data breaches.

Lack of Regular Security Updates:

Due to either resource constraints or oversight, some banks might not keep their software and systems updated, leaving them vulnerable to known security flaws.

These risks can be exacerbated by Bangladesh’s low internet penetration and digital literacy challenges. For instance:

- Users unfamiliar with the signs of phishing might more easily fall victim to scams.

- Due to a lack of awareness, the populace might be less likely to employ personal cybersecurity measures, such as firewalls or antivirus software.

- Low internet penetration may also mean that many users access services through public or unsecured networks, amplifying the risk of MitM attacks.

Mitigating these risks requires a combination of regulatory guidelines, technical fortification by the banks, and public awareness campaigns to educate users about safe online practices. I discussed this in detail below.

Fortifying Digital Banks with Proactive Strategies

Achieving the full potential of this initiative demands a vigilant approach to security. This means prioritising digital education to ensure users can identify and navigate around potential threats. An established regulatory framework is also crucial, mandating digital banks to adhere to top-tier cybersecurity standards. Initiatives like regular cybersecurity evaluations, penetration tests, and threat drills can solidify the defence mechanisms of these banks. Here are some proactive measures that can fortify the digital banking ecosystem:

Robust Authentication Protocols:

Implement multi-factor authentication (MFA) or two-factor authentication (2FA) using SMS, email, or biometric verification to ensure only authorised access.

End-to-End Encryption:

Ensure all data, both in transit and at rest, is encrypted. This includes data exchanged between client devices, bank servers, and third-party integrations.

Regular Security Audits:

Perform routine security audits and penetration testing to identify vulnerabilities in the system before they can be exploited.

Employee Training:

Regularly train bank employees about the latest cybersecurity threats and best practices. Ensure they understand the importance of maintaining confidentiality and recognising potential security threats.

Public Awareness Campaigns:

Launch campaigns to educate customers about safe online banking practices, recognise phishing attempts, and the importance of regularly updating passwords.

Secure API Management:

If third-party integrations are necessary, ensure APIs are securely managed, documented, and regularly reviewed.

Real-time Monitoring:

Implement systems that monitor transactions and user activities in real-time to identify and prevent suspicious activities.

Backup and Recovery Plans:

Ensure data is backed up regularly and can be quickly restored. Implement disaster recovery plans to maintain service continuity during unforeseen disruptions.

Collaboration with Cybersecurity organisations:

Partner with cybersecurity firms to benefit from their expertise and stay updated on the latest security threats and solutions.

Implement AI and Machine Learning:

Utilise artificial intelligence and machine learning to analyse user behaviour, recognise suspicious activities, and predict potential threats. I have discussed this in detail in the next chapter.

Regulatory Compliance:

Ensure compliance with local and international cybersecurity standards and regulations. Regulatory bodies can provide guidelines and frameworks to bolster cybersecurity.

Incident Response Plan:

Develop a clear protocol to follow in case of a security breach, including notifying affected customers and regulatory bodies and taking immediate corrective actions.

Customer Support:

Establish dedicated channels for customers to report suspicious activities and seek security-related guidance.

Software Updates:

Regularly update all software components, including banking applications, server software, and third-party plugins, to patch known vulnerabilities.

Secure Development Practices:

Adopt a secure coding practice, ensuring the bank’s software is developed with security in mind from the ground up.By adopting these proactive measures and fostering a culture of continuous improvement and vigilance, digital banks can build a secure and resilient infrastructure that wins the trust of their users.

Harnessing AI for Digital Bank Security

The realm of Artificial Intelligence (AI) offers promising solutions for enhancing digital bank security. By leveraging AI, digital banks can proactively pinpoint and counteract potential threats. Features like AI-powered behavioural analytics can identify irregular user patterns, thus flagging or halting suspicious activities. Moreover, AI aids in real-time monitoring, detecting phishing attempts, and predicting possible future threats based on historical data. In essence, AI acts as a vigilant guardian, shielding digital banks from the multifaceted cyber risks of today. These AI solutions can proactively detect, analyse, and neutralise threats. Here are some of the AI-driven security solutions that digital banks in Bangladesh could adopt:

Behavioral Analytics:

AI algorithms can monitor user behaviour, including login times, transaction patterns, and access points. If the system detects unusual behaviour that deviates from a user’s typical pattern, it can flag or halt potentially fraudulent activity.

Fraud Detection:

AI can analyse vast amounts of transaction data in real time to identify unusual patterns or anomalies that might indicate fraudulent activity. The system can then take automated action or alert human investigators.

Phishing Detection:

AI can be trained to identify phishing attempts in emails, messages, or malicious websites, thereby protecting employees and customers from these attacks.

Natural Language Processing (NLP):

NLP can be used in chatbots to answer security-related queries from customers, but they can also monitor for suspicious or malicious commands and queries.

Threat Intelligence:

AI can scan and analyse vast datasets from various sources to predict and identify emerging threats or vulnerabilities in real time.

Biometric Authentication:

AI can enhance biometric systems by analysing fingerprints, voice recognition, or facial recognition data more accurately, ensuring only authorised users gain access.

Security Automation:

In response to detected threats, AI can automate certain defensive measures, like isolating affected systems or blocking suspicious IP addresses.

Real-time Network Analysis:

AI-driven solutions can monitor network traffic in real time, ensuring no malicious data packets enter the bank’s digital infrastructure.

Predictive Analytics:

By analysing past security incidents and patterns, AI can predict potential future threats, allowing banks to take preventative measures.

Chatbot and Voice Recognition Systems:

Beyond customer service, these can be used to authenticate users based on voice patterns and to detect and block suspicious queries.

Secure Document Analysis:

AI can scan and analyse documents for hidden malware or malicious codes embedded in seemingly innocuous files.

Endpoint Protection:

AI algorithms can monitor the activities on end devices, such as mobiles or PCs, ensuring malware or hackers don’t exploit any vulnerabilities.

Automated Incident Response:

If a security incident does occur, AI can assist in understanding the breach’s scope of potentially affected data and recommend actions or remedies.

For these AI-driven solutions to be effective in Bangladesh, there should be an emphasis on:

- Collaboration between digital banks, tech organisations, and cybersecurity specialists

- Regular updating of AI algorithms based on evolving threat patterns

- Comprehensive training for bank staff on the importance of cybersecurity and how AI aids in that endeavour

- Continuous research and investment in emerging AI-driven cybersecurity technologies.

With suitable investment and implementation, AI-driven security solutions can provide digital banks in Bangladesh with a robust defence against a wide range of cyber threats.

Conclusion

Bangladesh’s venture into the domain of digital banks is a testament to its forward-thinking approach and adaptability. The cybersecurity challenges are undoubtedly present, but with an amalgamation of user awareness, robust regulations, and groundbreaking technology like AI, Bangladesh is well on its path to redefining its banking ecosystem, aiming to offer convenience and security to its people.

Writer:

Enamul Haque

Author, Researcher & Data Whisperer, UK

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind