Digital banking has played a pivotal role in expanding financial access for millions in Bangladesh, showcasing technology’s capacity to uplift lives and create opportunities.

The nation’s high mobile penetration rate and the widespread adoption of Mobile Financial Services (MFS) like bKash and Nagad have empowered millions, especially in rural areas, by granting them access to financial services that were once out of reach.

However, this rapid digital transformation has not come without its challenges. As financial services increasingly migrate to digital platforms, Bangladesh faces a growing array of cyber threats that could undermine progress.

The Evolving Threat Landscape:

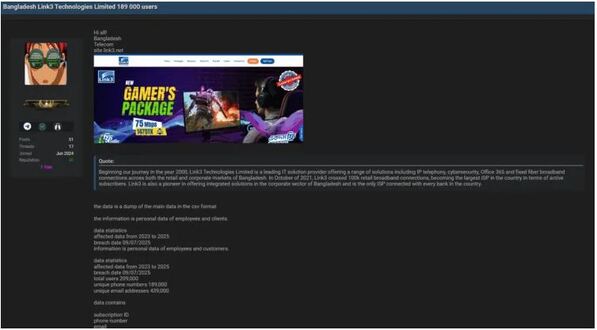

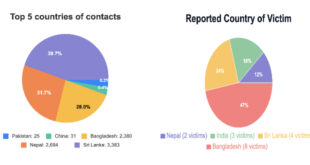

The cyber threats facing Bangladesh’s digital banking sector are multifaceted and constantly evolving. Phishing attacks, where cybercriminals impersonate legitimate institutions to trick users into revealing sensitive information, remain a persistent threat. Malware infections, often delivered through malicious apps or websites, can compromise user devices and steal financial data.

More sophisticated attacks targeting critical banking infrastructure have also been observed. These attacks, often perpetrated by well-organized cybercriminal groups, can disrupt financial services, cause significant economic losses, and erode public trust in digital banking.

Unique Challenges for Bangladesh:

Bangladesh faces unique challenges in addressing these threats. While a tech-savvy younger generation has readily embraced digital banking, a significant portion of the population remains less familiar with cybersecurity best practices. This lack of awareness makes them vulnerable to social engineering attacks and other scams.

Furthermore, the financial infrastructure itself is still evolving. While some banks have invested significantly in cybersecurity, others lag, creating vulnerabilities that cybercriminals can exploit. The disparity in cybersecurity maturity levels across the banking sector poses a systemic risk.

A Multi-Pronged Approach to Cybersecurity:

To safeguard its digital banking revolution, Bangladesh needs a comprehensive and multi-pronged approach to cybersecurity:

1. Education and Awareness: A nationwide effort to educate citizens about cyber threats is paramount. This should include targeted campaigns to reach vulnerable populations, such as older people and those in rural areas. Schools and universities should also incorporate cybersecurity education into their curricula to equip the next generation with the knowledge to navigate the digital world safely.

2. Strengthening Infrastructure: Banks and financial institutions must prioritize cybersecurity investments. This includes deploying advanced security technologies and implementing robust security policies and procedures. Regular security audits and penetration testing can help identify and address vulnerabilities before they are exploited.

3. Collaboration and Information Sharing: The government, financial sector, and cybersecurity experts must collaborate closely. Sharing threat intelligence, coordinating incident response efforts, and developing joint strategies can enhance the nation’s cybersecurity posture.

4. Regulatory Framework: A clear and enforceable regulatory framework for cybersecurity in the financial sector is essential. Regulations should hold financial institutions accountable for cybersecurity lapses and incentivize them to adopt best practices.

The Way Forward:

Bangladesh’s digital banking revolution has the potential to transform the nation’s economy and empower its people. However, this potential can only be fully realized if cybersecurity is prioritized. By investing in education, strengthening infrastructure, fostering collaboration, and establishing a robust regulatory framework, Bangladesh can ensure that its digital banking sector remains secure, resilient, and inclusive.

The stakes are high, but the rewards are even higher. By addressing the cyber threats head-on, Bangladesh can continue its journey towards a more prosperous and digitally empowered future.

Enamul Haque – Author, Researcher & Data Whisperer, UK

Read more article from Enamul Haque:

Cybersecurity Risks in Digital Banks of Bangladesh

Addressing the Critical Cybersecurity Landscape of 2024

The Top 5 Cybersecurity Threats to Businesses in 2023

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind