Bangladesh Bank dissolved the Board of Directors of National Bank. On Thursday (December 21), Bangladesh Bank has issued an order to dissolve the current board of the bank and form a new board.

It is known that a new board of seven members has been formed where Ron and Rick Haque Shikder are left out. This decision has been taken to protect the interests of the depositors and public interest.

By infosecbulletin

/ Wednesday , September 17 2025

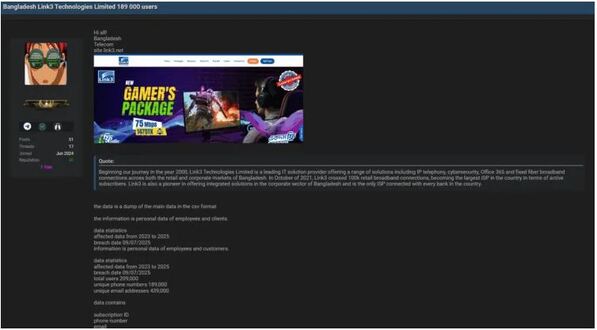

A threat actor claims to have breached Link3, a major IT solutions and internet service provider based in Bangladesh. The...

Read More

By infosecbulletin

/ Wednesday , September 17 2025

Check point, a cyber security solutions provider hosts an event titled "securing the hyperconnected world in the AI era" at...

Read More

By infosecbulletin

/ Tuesday , September 16 2025

Cross-Site Scripting (XSS) is one of the oldest and most persistent vulnerabilities in modern applications. Despite being recognized for over...

Read More

By infosecbulletin

/ Monday , September 15 2025

Every day a lot of cyberattack happen around the world including ransomware, Malware attack, data breaches, website defacement and so...

Read More

By infosecbulletin

/ Monday , September 15 2025

A critical permission misconfiguration in the IBM QRadar Security Information and Event Management (SIEM) platform could allow local privileged users...

Read More

By infosecbulletin

/ Monday , September 15 2025

Australian banks are now using bots to combat scammers. These bots mimic potential victims to gather real-time information and drain...

Read More

By infosecbulletin

/ Saturday , September 13 2025

F5 plans to acquire CalypsoAI, which offers adaptive AI security solutions. CalypsoAI's technology will be added to F5's Application Delivery...

Read More

By infosecbulletin

/ Saturday , September 13 2025

The Villager framework, an AI-powered penetration testing tool, integrates Kali Linux tools with DeepSeek AI to automate cyber attack processes....

Read More

By infosecbulletin

/ Saturday , September 13 2025

Samsung released its monthly Android security updates, addressing a vulnerability exploited in zero-day attacks. CVE-2025-21043 (CVSS score: 8.8) is a...

Read More

By infosecbulletin

/ Saturday , September 13 2025

Albania has appointed the first AI-generated government minister to help eliminate corruption. Diella, the digital assistant meaning Sun, has been...

Read More

Executive Director and Spokesperson of Bangladesh Bank Mezbaul Haque sai, Syed Farad Anwar will serve as the Chairman of the newly formed Board of Directors who is currently serving as Independent Director of Meghna Bank. Apart from that, Bangladesh Bank’s former executive director Sirajul Islam, Southeast Bank’s former managing director Md. Kamal Hossain, Khalilur Rahman, Parveen Haque Sikder, Shafiqur Rahman and Moazzem Hossain are the directors. Three directors of the previous board of directors have been appointed to the new board of directors. The rest of the directors were declared ineligible. He also said that the total number of directors in the previous board was eight. Three of them got a place in the new board.

According to Bangladesh Bank data, the combined capital shortfall of banks in the third quarter ended September 30 was Tk 37,506 crore. This figure for September was the highest deficit. Earlier, the highest deficit recorded in the last quarter of 2021 was Tk 33 thousand 744 crore.

As per international regulatory framework Basel III, the minimum capital adequacy ratio (CAR) for banks is 10.5 percent. In addition to this, an additional two and a half percent has to be kept as security. 14 banks failed to maintain minimum CAR. The banking sector’s CAR was 11.08 percent in September.

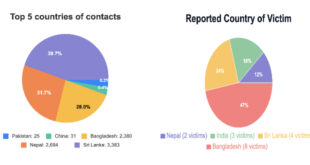

According to the Central Bank’s Financial Stability Report 2022, banks in the country continue to have the lowest CARs in South Asia. The capital deficit of most of these 14 banks increased from last July to September.

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind