HSBC Bank Australia Limited did not sufficiently safeguard customers from scams that resulted in millions of dollars being lost, as stated in documents filed by The Australian Securities and Investments Commission (ASIC) ASIC in the Federal Court today.

ASIC claims that HSBC Australia lacked sufficient controls to prevent unauthorized payments and did not meet its obligations to investigate customer reports of such transactions on time or promptly restore banking services.

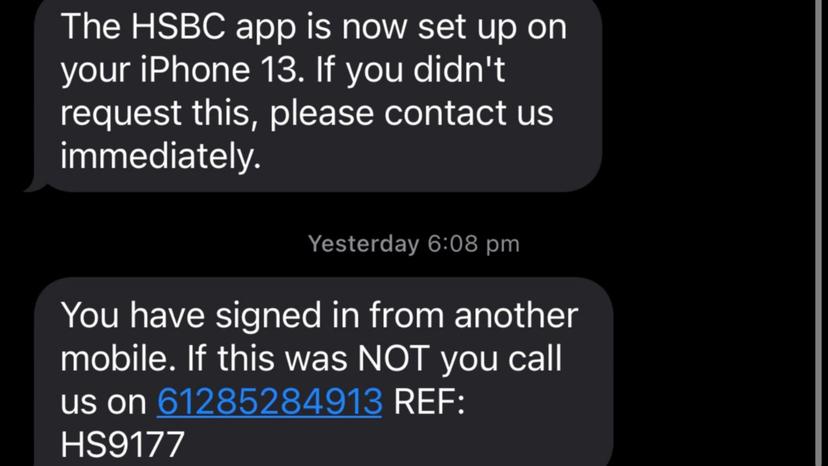

ASIC alleges a rise in unauthorized transactions among HSBC Australia customers since mid-2023, mainly due to scammers impersonating bank staff to access accounts.

From January 2020 to August 2024, HSBC received around 950 reports of unauthorized transactions, leading to customer losses of about $23 million. Nearly $16 million of these losses happened between October 2023 and March 2024.

ASIC Deputy Chair Sarah Court said, ‘We allege HSBC Australia’s failings were widespread and systemic, and the bank failed to protect its customers.

Since January 2023, we claim that HSBC Australia knew about the risks of unauthorized transactions and had weaknesses in their fraud controls, leading to some customers losing over $90,000 to scams.

‘We claim that HSBC Australia made the situation worse by not following the ePayments Code and failing to support its customers when they needed help the most, taking an average of 145 days to investigate scam reports.’

‘HSBC Australia took an average of 95 days to fully restore customers’ access to their bank accounts, with one customer waiting 542 days.

Ms Court said it was too early to speculate on the extent of the penalties and costs that HSBC might incur as a result of the legal action.

“In this case the maximum penalties are so high that I would say they are almost theoretical,” she said.

“What I can tell you though is that if we are successful in that case, will be seeking very significant penalties, firstly to send a message to HSBC … but also importantly to send a broad message to the banking sector … that they have to take these obligations very seriously.”

The Australian Financial Complaints Authority (AFCA) received 360 complaints regarding the HSBC spoofing scam, but only 17 of those are still open.

HSBC stated that it has been collaborating with AFCA.

“Almost all of those remaining cases have now been resolved and those that remain are expected to be resolved shortly,” it said.

“We continue to make significant investments in our fraud and scam prevention, detection, and response, with specific efforts on preventing impersonation scams and ‘spoofing’ of phone numbers.”

HSBC has restricted some risky payments, like those to cryptocurrency platforms, and added SMS alerts for transactions over $500.

Source: The Australian Securities and Investments Commission (ASIC)

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind