Kori Digital Bank’s Chairman Habibullah N Karim said, the bank will start its operation in October; it’s all preparatory work is going in full swing, we hope soon will get final license.

He said, after getting LOI, we were working tirelessly to start the banking operation within the time span given by Bangladesh Bank.

We recently took our registration from Registrar of Joint Stock Companies for a business entity.

Habibullah N Karim said, Cyber security is a prime concern for us because our all transaction will be done digitally as there will be no branches without head office. Obviously, the is a trust issue of our customers.

The bank will connect the unprivileged, rural people, so there is much to be aware of in security perspective he said. Till a major portion of people of Bangladesh don’t connect with Smartphone’s, they should have aware of digital literacy.

As like conventional banks, the digital bank will serve the same things but it will focus on micro loan and transactional activities specially. “We want to make the bank, accessible for all” he quoted.

More Digital banks to come, Gov.t green signals:

Bangladeshi Finance Minister Abul Hasan Mahmud Ali said yesterday that the government has agreed to increase the number of digital banks in the country. On Thursday (June 6), the Finance Minister highlighted the issue in the proposed budget for the fiscal year 2024-25.

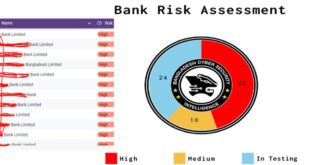

There are currently two approved digital banks in the country. They are cash and card digital banks. According to the proposed budget, two digital banks have been given letters of intent on October 25, 2023, to deliver global IT-based digital banking services to the people with the aim of building a ‘Smart Bangladesh’ announced by the Bangladesh government. They are – Nagad Digital Banking PLC and Kori Digital Banking PLC.

It is also said that the government plans to increase the number of digital banks later. Credit scoring system will be introduced by applying artificial intelligence (AI) and machine learning technology in lending from digital banks. As a result, it will be possible to identify fake and anonymous borrowers very easily. Besides, the loan taking process will be much easier for genuine borrowers.

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind