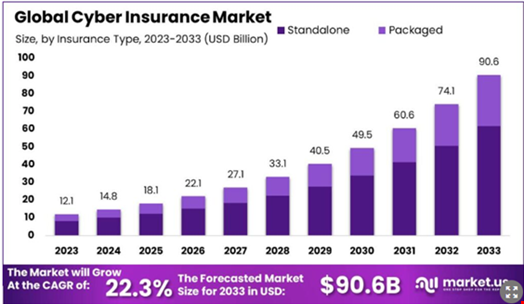

The global cyber insurance market is expected to reach $90.6 billion by 2033, with a growth rate of 22.3% annually from 2023, as analyzed by Market.Us. The industry is expected to reach $14.8 billion by the end of 2024, up from a projected $12.1 billion in 2023.

The report pointed out reasons why more businesses will get cyber insurance in the next 10 years.

- Rising cyber threats and attacks

- Evolving regulatory environment

- Increasing financial impact of cyber incidents

- Growing awareness and understanding of cyber risks

Cyber Insurance Trends in 2023

According to the analysis, standalone cyber insurance policies accounted for over two-thirds (68%) of the market in 2023. The policies are designed for specific cyber threats that businesses face like data breaches and ransomware. Large organizations and industries vulnerable to cyber threats, like finance and healthcare, especially prefer standalone policies.

In the cyber insurance market last year, third-party coverage dominated with a 62.1% share. These policies protect against legal costs and liabilities caused by breaches that impact customers and other parties’ data.

Companies that deal with sensitive customer information are investing more and more in third-party insurance. This is because of the increasing number of data protection regulations, which create the possibility of lawsuits and fines.

In 2023, the value of the cyber insurance market was mainly driven by large businesses, which accounted for 72.4% of the market. Large enterprises are at a higher risk of cyber incidents because they have a widespread and complicated digital infrastructure.

The largest market share was held by the banking, financial services, and insurance (BFSI) sector, with 28.3%.

This is because these industries deal with sensitive financial information, making them attractive to cybercriminals. To protect themselves from financial and reputational damage caused by data breaches and online fraud, these businesses invest in cyber insurance policies.

North America had the biggest share of the cyber insurance market, with 37.6% ($4.5bn). This is because the region has advanced technology, many major global companies, and a strong understanding of cyber threats.

Opportunities for Cyber Insurers to Improve:

The report outlined ways cyber insurers can enhance their value to businesses in the face of rising cyber-threats:

- Tailor policies for specific industries, such as healthcare, finance or manufacturing, to address their unique risks and compliance requirements

- Provide holistic risk management services to help organizations proactively manage cyber risks. These include cybersecurity assessments, incident response planning and employee training

- Partner with cybersecurity firms to integrate capabilities like risks assessment

- services, threat intelligence and incident response capabilities

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind