ISACA Dhaka chapter arranged a Continuing Professional Education (CPE) seminar for the community as its calendar work to develop the professionals.

On 28 December, Saturday at ISACA Dhaka office with the participation over 50 participants the seminar draw the attention with the two leading topic on “Leadership & Communication is intertwined- The Art of inspiring and connecting” and “A smart Approach to Comply with Bangladesh Bank’s requirement of CAAT software Implementation”.

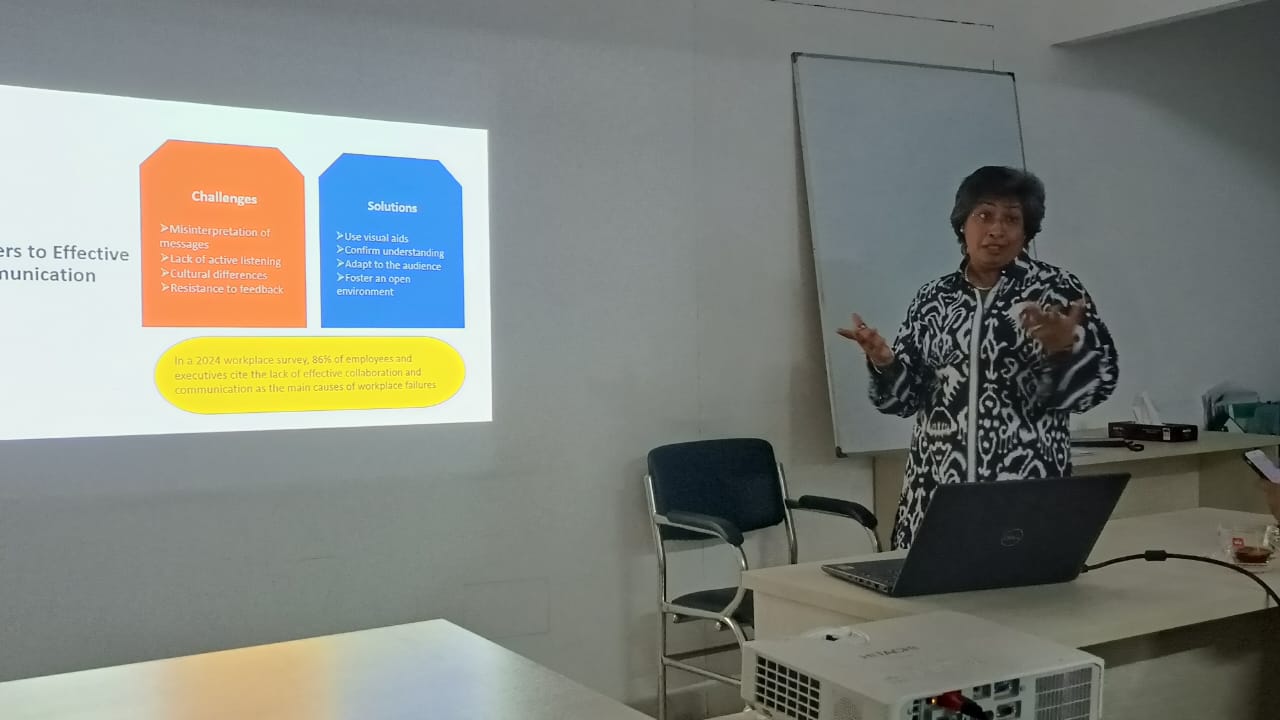

Sarah Ahmed Abedin, Ex. President of ISACA Washington Chapter, USA highlighted on the topic “Leadership & Communication is intertwined- The Art of inspiring and connecting”. He explained Leadership and communication are closely linked. Successful leaders communicate clearly, empathetically, and inspiringly. Without the ability to share their vision, motivate their team, and form strong relationships, leaders are less likely to succeed.

Inspiring leadership includes more than giving orders; it requires creating a vivid vision of the future, aligning individual and team goals, and fostering a shared purpose. This demands strong communication skills to articulate the vision, tell engaging stories, and persuade others.

Building connections is also vital. Effective leaders foster trust, encourage open dialogue, and create a sense of community. Those who connect personally with their team gain respect, loyalty, and commitment by practicing active listening and empathy, understanding their team’s needs and concerns.

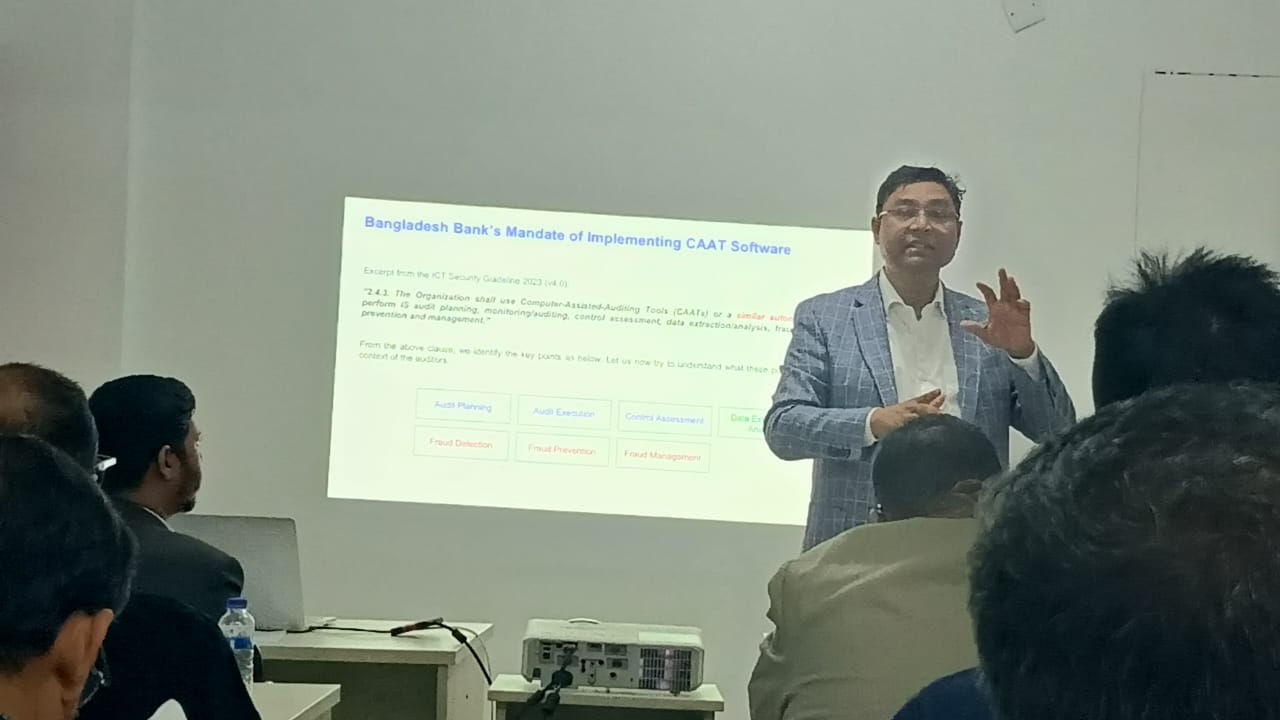

On the topic “A smart Approach to Comply with Bangladesh Bank’s requirement of CAAT software Implementation” Managing Director, Innovatives Minds Consulting ltd Mamunur Rahman insightfully presented how to comply with Bangladesh Bank’s CAAT (Computer Assisted Audit Techniques) requirements.

Mamunur Rahman elaborated the process from top to bottom. He said, Banks should follow a structured approach to do that. They must understand the regulatory guidelines and audit needs perfectly. Selecting appropriate CAAT software that offers data analysis, automation, and risk-based auditing features is vital.

The software should integrate seamlessly with existing systems and be customized for internal processes and strong data security and privacy measures must be in place.

Automating audit processes and conducting continuous monitoring will help identify discrepancies and reduce risks. Regular testing, validation with Bangladesh Bank, and generating compliant audit reports are necessary. Lastly, banks should ensure ongoing updates to keep up with changing regulations.

InfoSecBulletin Cybersecurity for mankind

InfoSecBulletin Cybersecurity for mankind